Merger and acquisition transactions typically raise complex financial, regulatory and operational issues.

Price remains a critical factor for acquirers and sellers, but dozens of other matters must be managed effectively to complete the deal. This is where Dextra M&A can help.

How we can help

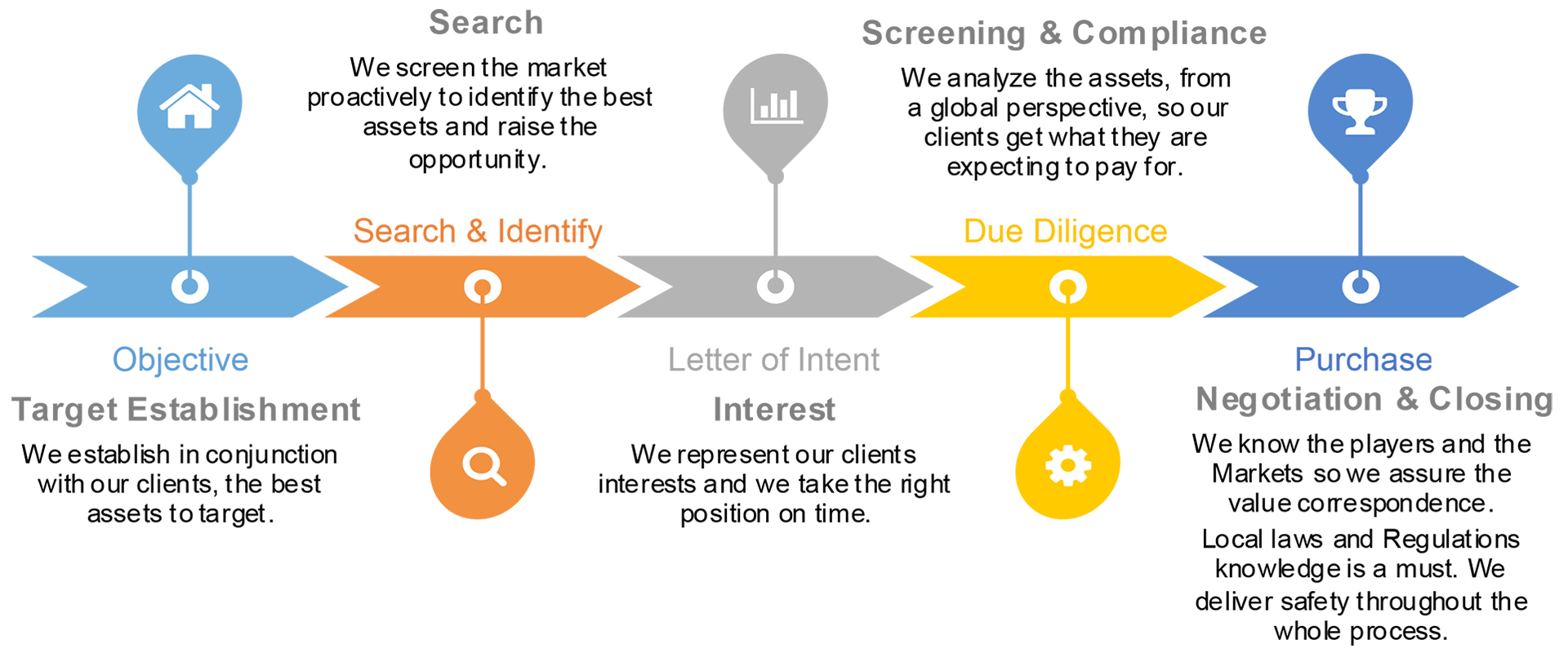

Dextra M&A helps corporations and private equity clients identify and set up transactions and then take them to successful completion.

Our services include:

Our M&A advisers are skilled, experienced professionals. They offer advice that is clear, objective and practical.

They draw on the support of DEXTRA’s dedicated industry knowledge.

Importantly, DEXTRA M&A never takes a debt or equity position in any deal on which it advises, underwriting our reputation for objectivity and impartiality.

Our international network gives DEXTRA M&A a presence in all of the world’s main commercial and financial centres. It is a presence that makes a big difference in accessing vital market intelligence and getting the deal done.